Why I treat Markets Like a Math Problem

Most people trade with emotion. I treat it like math. Toronto might run on chaos and construction, but beneath the noise, there’s structure; and that’s how I see markets.

What Does Math Have to Do With Anything?

Math is objective. Apply the right formula, and you get the right result. It’s based on logic and deduction, not bias, emotion, or some influencer's opinion. In markets that thrive on noise, math brings silence. And if you use it correctly, you can beat the game that most people lose.

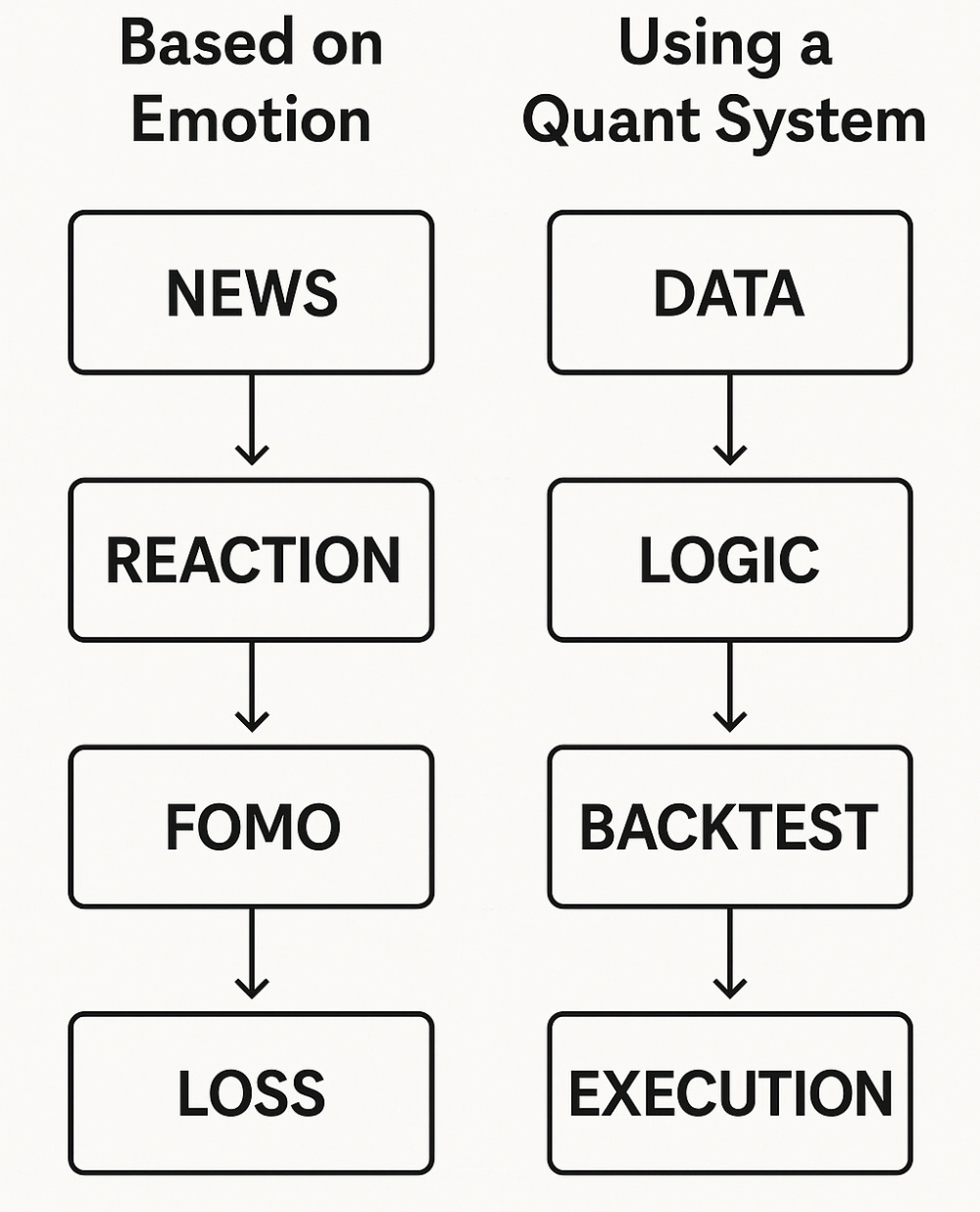

Emotion vs Logic

Markets are emotional. People chase hype, panic on dips, follow trends late, and hold losers out of pride. But math? Math doesn’t care. It doesn’t feel fear, greed, or FOMO. It doesn’t care what CNBC says or who tweeted what. It cares about data, probabilities, and patterns that actually move the needle.

That’s why quants and system-based traders win more often. They aren’t reacting — they’re executing.

Systems Over Guesswork

A math-driven approach means building systems, not relying on luck. You test an idea, prove the edge, measure risk, and repeat. There’s no need for predictions — just preparation. And if the edge fades, the system adapts.

This is what separates a gambler from a strategist. One hopes. The other calculates.

The Real Edge

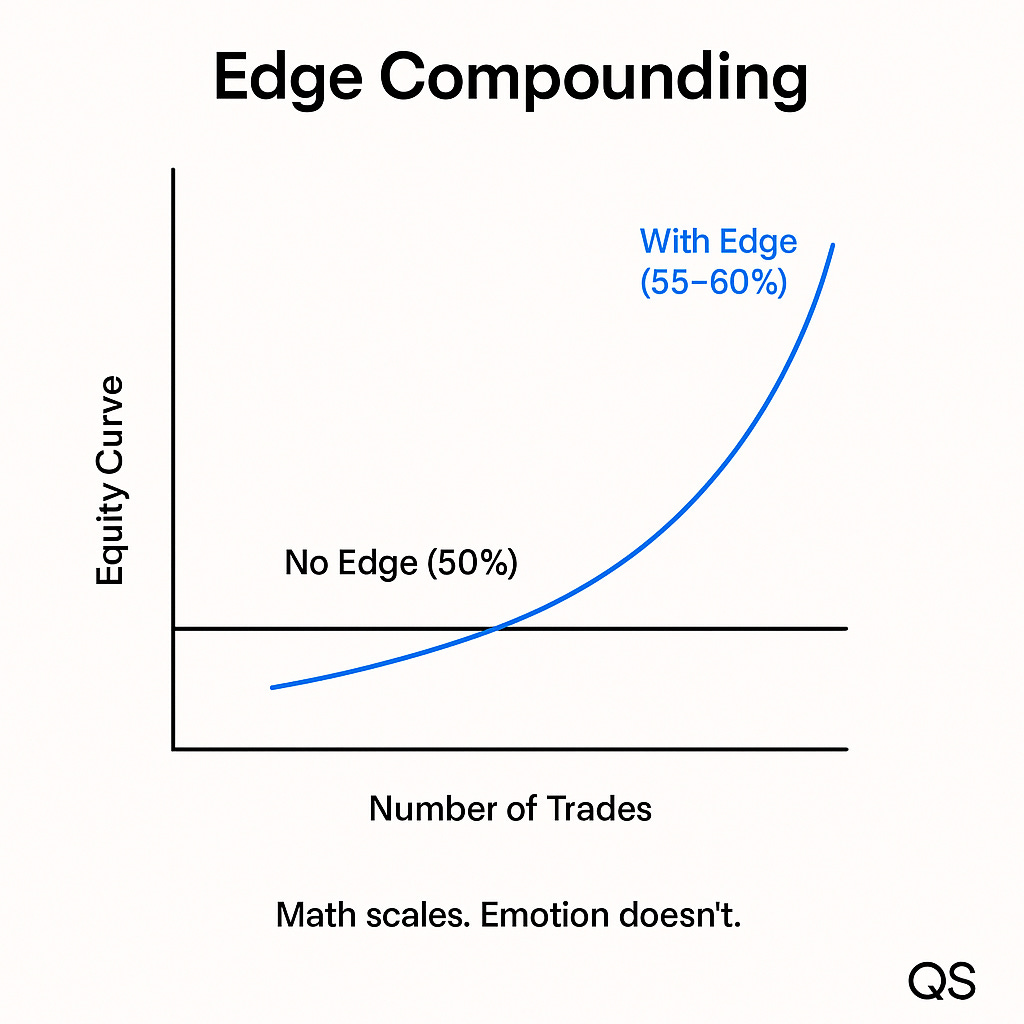

It’s not about being right once. It’s about being consistently slightly more right than wrong, and letting time do the compounding.

A 55-60% edge, repeated over hundreds of trades, becomes a career. Math helps you find that edge and prove it before putting real capital at risk.

Most people want shortcuts. Math forces you to be honest. It won’t flatter you. It won’t lie. But if you respect it, it’ll pay you.

Why Most Lose

The average trader is emotionally reactive, poorly disciplined, and anchored to opinions. They follow headlines, mimic gurus, and treat the market like a slot machine.

Quantitative traders don’t play that game. They write their own rules, test them, and execute with precision. They treat the market like a business, not a bet.

How to Start Thinking Like a Quant

You don’t need to be a math prodigy. You need to respect data, trust logic, and stay disciplined. Learn basic statistics—study risk management. Write code. Backtest everything. Remove emotion from your process.

You’ll be shocked how many “winning strategies” fall apart under scrutiny — and how a simple, clean model can outperform complex noise.

Final Thought: Math Holds

Narratives shift. Opinions die. Hype fades. But math?

Math holds.

Stop guessing and start measuring if you want to last in this game. The market won’t reward hope. But it will reward systems.

So build one. Test it. Refine it.

And let the math speak for itself.

If you’re interested in learning more, subscribe; it’s free ;)

And share, please, maybe.